Posted 07/30/2012

The developer of 62 acres of land near Waikoloa, Hawai’i, has registered its intentions to raise some $37.5 million in capital through a public offering of stock.

The registration was made with the Securities and Exchange Commission on July 27 by Aina Le’a, Inc., a new company that emerged from the reorganization last February of Aina Le’a, LLC. (The website of the state Department of Commerce and Consumer Affairs’ Business Registration Division still shows Aina Le’a, LLC, as an active business, while Aina Le’a, Inc., obtained a temporary registration last February that has since expired.)

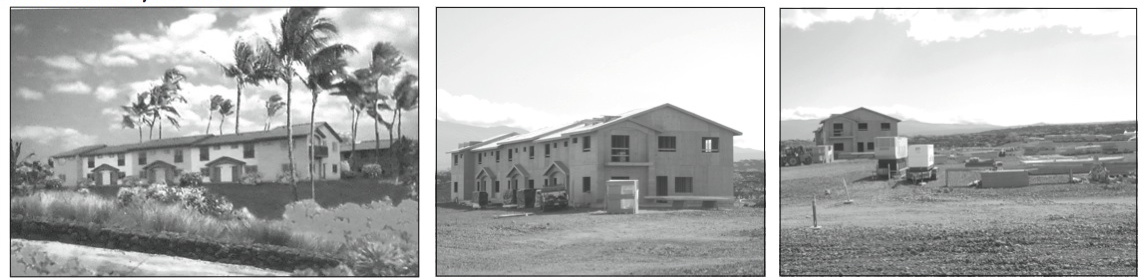

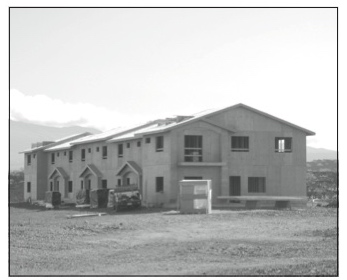

The 62-acre parcel, on which several buildings in various stages of completion now sit, is part of the larger Villages of Aina Le’a project that is at the heart of a much-watched federal lawsuit over development rights. The history of the project, on more than 1,000 acres of mostly barren, volcanic land, stretches back more than two decades, when the state Land Use Commission first approved a petition to reclassify the land into the Urban land use district. Two years ago, in light of unfulfilled promises to complete the required fraction of affordable housing, the LUC sought to revert the land to the state Agricultural district. Both Aina Le’a and Bridge Aina Le’a, Inc., which still owns the bulk of the project area, sued. Third Circuit Judge Elizabeth Strance overturned the LUC ruling. The state is appealing that decision.

Aina Le’a has raised most of its capital so far through the sales of undivided land fractions, or ULFs, it told the SEC. To date, about 900 ULF purchasers have been registered with the Bureau of Conveyances, each owning a share in the land and each having been promised a 12 percent annual return on investment, with payout within 30 months of the initial purchase. According to the SEC filing, since 2009, Aina Le’a has “raised over $39 million of equity capital … from approximately 921 ULF purchasers.” However, elsewhere in the prospectus, “net cash receipts” from the ULF program are said to be “approximately $13.7 million.”

In February, when the reorganization occurred, the company offered 4 million shares of common stock to “holders of beneficial interests in a land trust” – presumably made up of the Malay and Singaporean investors — owning almost 60 percent of the 61.37-acre parcel, in exchange for acquiring the trust’s interest in the land. Another 5.5 million shares were issued to parent company DW Aina Le’a, LLC, which is controlled by Robert Wessels, CEO of the new corporation and manager of DWAL. Now, six months later, the company is proposing the public sale of the common stock offered to those with a stake in the land trust.

The company describes several possible risks to shareholders. Among the most damaging is a possible adverse outcome to the company in the ongoing litigation over land development rights. “If the state commission wins on appeal,” the prospectus states, “we will be unable to further develop the land.” Should that occur, “you could lose some or all of your investment,” the company informs potential investors.

The prospectus makes slight mention of other litigation, including claims by Goodfellow Bros. to be owed several million for site development work and a lawsuit by the Mauna Lani Resort Association challenging the environmental impact assessment for the project. With regard to the Goodfellow Bros. claims, “we are currently awaiting the arbitrator’s ruling which is expected to be provided in late August 2012,” the prospectus states. Lyle Hosada, attorney for Goodfellow, told Environment Hawai’i that Goodfellow is owed about $3 million at this time. As for the challenge to the EIS, “We do not anticipate any material consequences from the Mauna Lani lawsuit,” the company says.

Also, anyone reading the prospectus might be led to think the townhouses being built on the property are already in the process of being sold. “The homes are approved for 3.5% FHA financing and sell at the County of Hawai’i pricing for locals,” it states. Infrastructure support for the development – including water, the sewer, and roads – is far from complete. The company also claims that it will develop 70 single-family residential building lots, now “in the subdivision approval process.” When that is completed, “the lots will be listed for sale to builders at prices from $300,000 to $750,000 per lot.”

Environment Hawai`i has published many articles on the proposed `Aina Le`a development. Browse our archives or use our search engine to find them.

Leave a Reply