The Hawaiʻi County Office of the Auditor has released its report on the handling of affordable housing credits issued by the Office of Housing and Community Development (OHCD). And it isn’t pretty.

The County Council requested the audit after the U.S. attorney in Honolulu, Claire Connors, brought criminal charges against four men – including a former county Housing Office employee – accused of gaming the county’s system of awarding housing credits in return for the development of affordable housing units. Altogether, the federal government alleges, the men enriched themselves through fraudulently obtained credits to the tune of more than $10 million.

Conducted under the supervision of county auditor Tyler Benner, the audit found little good to say about the OHCD’s practices prior to the issuance of federal criminal charges. Of the 49 developers receiving excess affordable housing credits, the OHCD had no affordable housing agreement on file for 24 of them, or nearly half, the report found. The agreements with four other developers were missing required signatures. Seven developers were awarded credits before any housing was built, six developers resold those pre-awarded credits, and four developers resold pre-awarded credits without any affordable units constructed. Two developers were awarded more credits – a total of 48 more– than they were entitled to.

Overall, the audit found, “We found prior internal controls were generally inadequate and not operating according to best practices to prevent, detect, and deter fraudulent transactions.”

When addressing the circumstances that contributed to the fraud, the auditor notes one of the unique provisions in the County Code. “Other jurisdictions use a combination of in-lieu fees and land conveyance to satisfy all or a portion of housing obligations. Hawaiʻi County is the only county that awards ‘excess’ credits and does not charge in-lieu fees,” the report states.

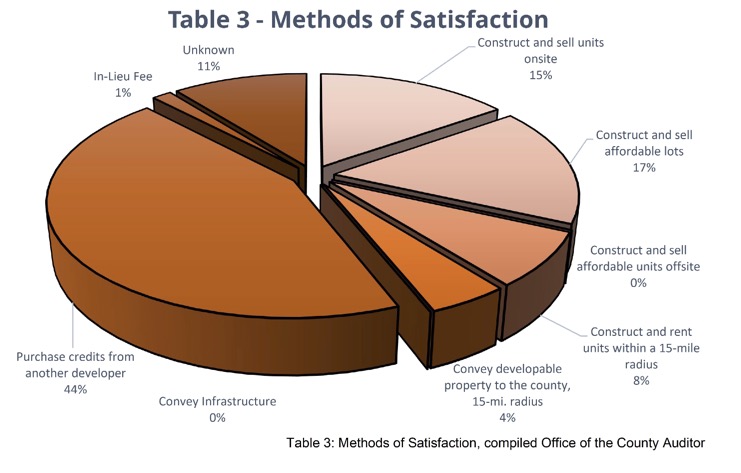

The complexity of Chapter 11 itself was identified as another contributing factor. That law offers developers and would-be developers a veritable smorgasbord of options by which affordable housing obligations tied to developments may be fulfilled: “developing finished lots, selling, or renting the required units on- or off-site, conveying land or infrastructure, or purchasing affordable housing credits.” Given this complexity, “At approximately 44 percent, purchasing [credits] has become the most often used method of satisfaction” of the affordable housing requirement, it found.

The relatively easy availability of credits has resulted in a market of sorts, small, yet often incredibly lucrative. Of the 1,800 or so credits that the OHCD has issued since 1988, at least 638, or 35.2 percent, “have been sold at least once,” the auditor found. “Historically, private credit sales have varied in price from as little as $5,000 to as much as $75,000 each.”

According to the audit, Housing Office staff said that “historically, they were advised not to interfere with private-party credit transactions.”

“However,” the audit continued, “credits have significant potential values. When used as intended, credits provide developers with a means to liquidity, which in turn contributes to housing production. However, when bought and held, the lack of liquidity means less overall capital investing in developments, and production suffers. As public stewards, behaviors, actions, and decisions must be made in the public’s best interest. OHCD should have a solid understanding of credits’ impact on production.

“The program has under-served communities around the island. Excess credits are bought and held for long periods rather than to produce housing units. For OHCD to successfully achieve its mission of providing affordable housing, foundational reforms must accompany improvements to its internal control system.”

Pre-Award of Credits

Following the revelations by the federal prosecutor last summer, details of two of the criminal schemes involving the award of excess affordable housing credits were aired in public (and also in the June 2022 issue of Environment Hawaiʻi). Central to those schemes was the pre-award of credits to two self-described development companies before the first shovel of earth was turned, before the very first approval of plans, and even before title to the land was deeded to the developers.

As the auditor discovered, however, the Office of Housing and Community Development had pre-awarded credits to not just those two firms, but to at least seven firms over the years. Six of them resold credits. Four of them resold the credits without any affordable units having been constructed.

In one of the pre-award cases, the developer was a non-profit; in that case, the pre-award of credits helped it to raise the capital needed to move forward with the development, much as was anticipated when Chapter 11 was adopted. That developer did build affordable units.

That leaves two cases in which the county pre-awarded credits to companies that then sold them off, with no affordable housing ever built by either the companies awarded the credits or the companies who purchased them: Lava Kuakini, LLC, which was pre-awarded 10 credits in 2005, and Suffolk Investment, which was pre-awarded 50 credits. Both those entities have been dissolved.

Poor Documentation

With access to records at the Office of Housing, the auditor was able to come up with a list of credits awarded, credits sold and purchased or otherwise alienated, and credits redeemed. Overall, the auditor could account for 1,811 total credits, all but 161 of which were awarded by the county. (The Department of Hawaiian Home Lands awarded those remaining 161 to developers of affordable housing on DHHL land, an award allowed under state law.)

Of the total number, 781 were sold, transferred, confiscated by the federal marshal, dissolved, or brokered. A total of 660 credits had been purchased, and 335.8 were redeemed, which means the county accepted the credits in satisfaction of developers’ affordable housing obligations. Altogether, the auditor concluded, there remain 1,354.2 credits still outstanding, available to be sold to developers wanting to satisfy affordable housing obligations by surrendering credits instead of building affordable homes or apartments or developing improved lots for sale at affordable prices.

But a relatively high percentage of the files for the various affordable housing projects – 40.7 percent, or 24 of the files – did not include executed affordable housing agreements. “Of the remaining projects,” the audit states, “we noted four instances where required signatures were missing.”

It goes on: “We note 22 instances where the Bureau of Conveyance (BOC) recordation could not be confirmed between missing AHAs or incomplete project files. Furthermore, we noted 12 instances of AHA were not recorded” with the Bureau of Conveyances.

The poor documentation, lack of signatures, lack of recordation, and other irregular features of several of the affordable housing agreements may yet change the total number of credits available. In a footnote, the auditor states: “The status of some projects may be pending administrative review by the Office of the Corporation Counsel and is subject to change.”

Recommendations

The litany of problems with the OHCD’s management of its system of awarding affordable housing credits and working out affordable housing agreements is extensive, as laid out by the Office of the County Auditor.

Its report identified four “deficiencies” related to OHCD’s compliance with Chapter 11:

- The OHCD pre-awarded and over-awarded affordable housing credits;

- It misinterpreted areas of the code;

- It lacked Internal control systems and program oversight; and

- There was no segregation of duties.

The OHCD also lacked clear policies and procedures, the auditor found:

- There were no administrative rules;

- The qualifications of developers were not vetted;

- There was no monitoring of compliance by contractors with the affordable housing agreements;

- The record of credits awarded was incomplete; and

- There was no timely recognition of the credits awarded by the DHHL.

To address these issues, the auditor listed seven recommendations:

- The Hawaii County Council should revise Chapter 11;

- OHCD should establish administrative rules regarding administration of its affordable housing policy;

- OHCD should “clarify and enforce policies and procedures to ensure consistency throughout the department and industry best practices;”

- OHCD should “perform ongoing monitoring of their internal control system’s design and operating effectiveness as part of their operations;”

- It should “use software and technology as a monitoring tool to improve managing affordable housing agreements and credits;”

- “Incompatible duties” should be segregated; “one individual should not oversee key elements of the affordable housing process;” and

- OHCD should provide ongoing internal control training to employees involved in the affordable housing process.

Response

Susan Kunz, the county housing administrator, replied to the audit in a letter appended to the report. Regarding the first recommendation, Kunz stated that her office had “already engaged a consultant” to review Chapter 11 and provide recommendations for changes. “The final report … should be available within the next two months.” Last summer, Kunz informed the council and Environment Hawaiʻi that the consultant’s report would be available in last September or October.

Kunz agreed that OHCD should adopt rules, but again proposed waiting until after the issuance of the consultant’s report and any changes to Chapter 11 that the council might approve “as a result of this audit.”

With respect to the third recommendation, Kunz said that her office “had already begun to establish written policies and procedures together with flow charts to document workflow on all processes associated with the implementation of Chapter 11.” She also concurred with the next recommendation, stating that her office “will regularly evaluate the effectiveness and efficiency of such ongoing monitoring and oversight and will implement changes/improvements as appropriate.”

As to the fifth recommendation, Kunz concurred, but with reservations. Her office would look into software options “within the limits of available resources,” she wrote.

In response to the critique that her office had not appropriately segregated incompatible duties, Kunz said the OHCD “has begun to separate duties by establishing policies, procedures, flow charts, and internal controls” to address this issue.

As far as training is concerned, Kunz stated that her office would “ensure that its employees are allowed to attend appropriate training sessions … such as ethics training” and would also use regular bi-weekly staff meetings “to train staff on different aspects of Chapter 11.”

Not waiting for the consultant’s report, the County Council has already moved to tighten up its oversight of OHCD. On February 8, it unanimously passed Bill 9, which amends section 19 of Chapter 11. Previously, that section, titled “Reports by housing administrator,” stated that the administrator “may provide timely periodic reports to the council … including but not limited to the approval of excess credits, the acceptance of transferred credits, and the choice of resale restrictions.”

Bill 9 amends that by making such reports mandatory instead of optional. Among other things, the housing administrator is now required to provide the council with any new affordable housing agreements within 30 days of the date of execution. Also, the administrator is to provide quarterly reports to the council that include a list of developers in possession of excess affordable housing credits and an accounting of “significant actions taken under authority” of Chapter 11. Mayor Mitch Roth signed the bill in late February.

The first such report from the housing administrator is to be submitted by March 1.

— Patricia Tummons

Leave a Reply