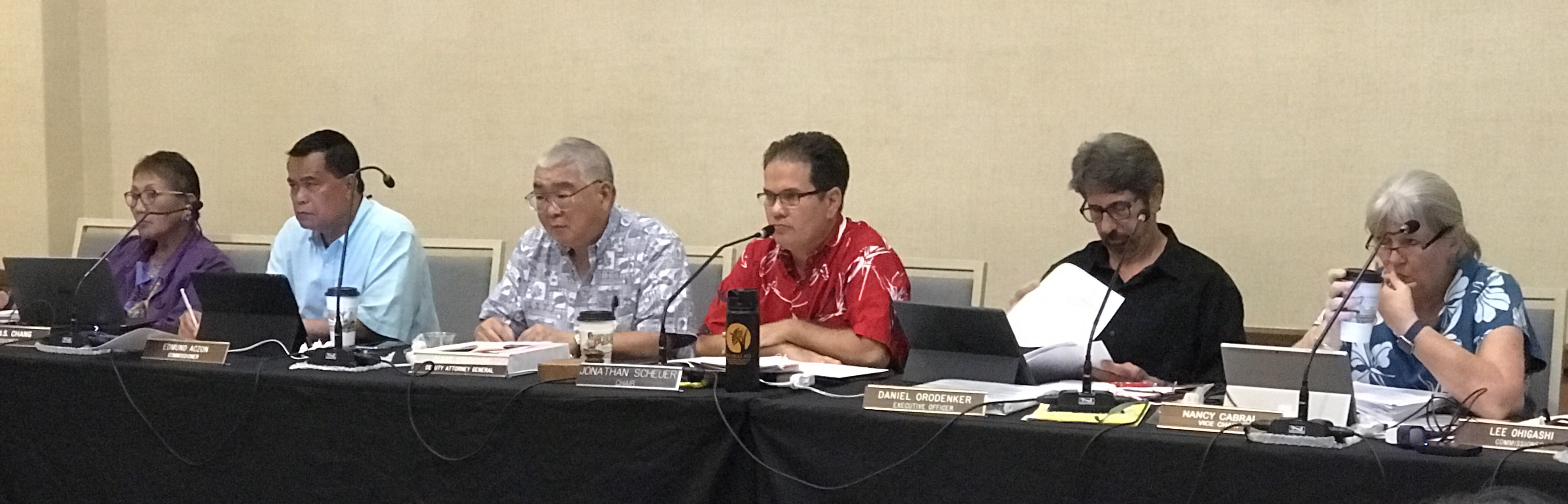

“There’s a Hawaiian word, kapulu,” Jonathan Scheuer noted near the end of a two-day hearing of the state Land Use Commission on the stalled Waikoloa Highlands project.

Scheuer, commission chair, continued. “Kapulu, that’s a shame thing to have. This project has been kapulu from the start, but I have no intention of having this proceeding go forward in a sloppy manner.”

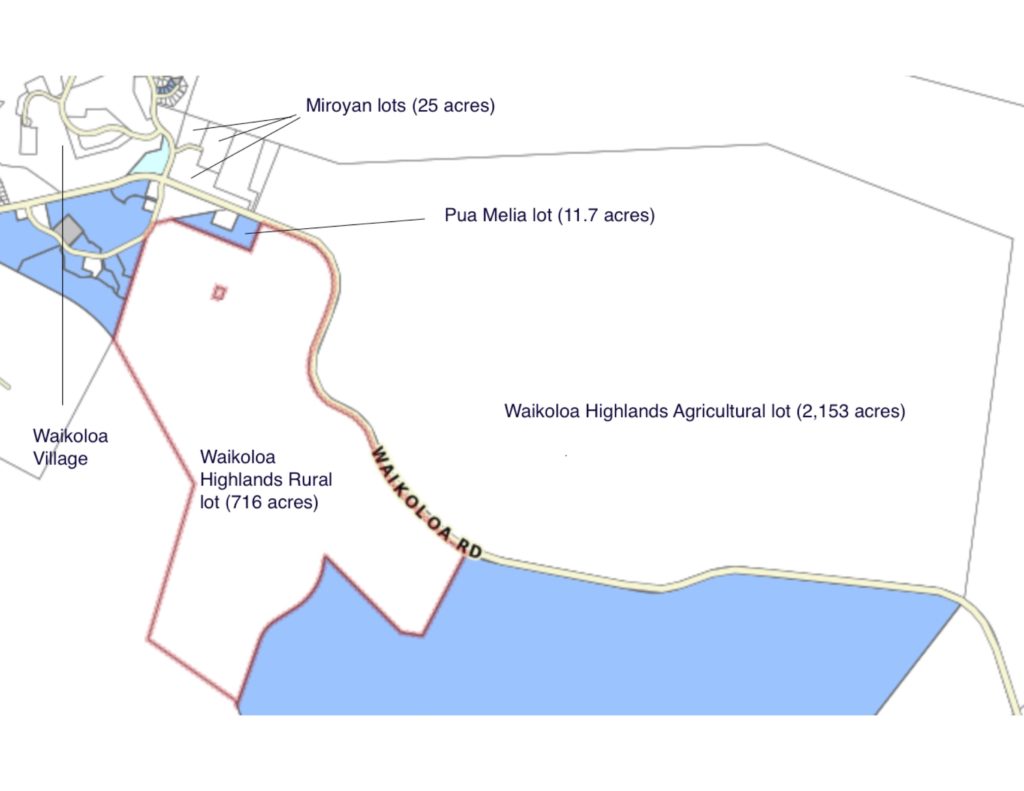

With that, Scheuer laid down conditions under which the parties to the commission’s proceedings – landowner Waikoloa Highlands, Inc., the Hawai‘i County Planning Department, and the state Office of Planning – would be continuing to argue their respective positions on the LUC’s Order to Show Cause (OSC) issued to Waikoloa Highlands in July. The order requires Waikoloa Highlands to plead its case to the commission as to why the commission should not revert the 731 acres it owns near the village of Waikoloa, in the Big Island district of South Kohala, to the state Agricultural land use district from the Rural district.

Back in 2008, the LUC conditionally approved the request of the landowner at the time, Waikoloa Mauka, LLC, to shift the land from Ag to Rural, which was a condition of a rezoning ordinance passed by the Hawai‘i County Council. One of the conditions the LUC imposed required completion of “backbone infrastructure” needed before the first residential lot could be sold within 10 years of the date of LUC approval, a date that passed in June.

Some of the more contentious issues that emerged during the LUC’s hearing, held in Kona on October 24 and 25 were:

• A dispute over whether Waikoloa Highlands (WHI) had satisfied the affordable-housing condition included in the LUC approval;

• Testimony by representatives of WHI as to its corporate structure and ownership that conflicted with exhibits WHI had entered into the LUC record;

• An effort by the project manager for WHI to influence individual members of the commission through disallowed ex-parte communication;

• Concerns over the availability of funds to complete the project;

• The potential threat of litigation over violation of due-process and equal- protection claims by the landowner’s attorney.

By the close of the October hearing, Scheuer and other commissioners had set forth a list of topics that they wanted to have briefed before the commission’s next scheduled meeting on the Big Island on November 28. Among other things, the commission seeks clarification of ownership and corporate structure from the landowner and, from the county, clarification of the affordable housing matter and explanation of the county’s zoning procedures. In addition, it desires to have the parties brief the commission on legal questions relating to how the commission’s original 2008 order should be interpreted.

The Opening Shot

Within moments of the hearing having opened, the first foreshadowing of the messiness – kapulu – occurred. Commissioner Nancy Cabral made a disclosure. “I want to let you know for the record, I do know Joel LaPinta,” Cabral said, referring to WHI’s project manager. “I received an unsolicited phone call from him last week. He said he was calling on behalf of the Waikoloa matter and made statements about the ownership of the property, that the current ownership is distinguishable from the former.”

“He impressed on me the need for Hawai‘i to have additional affordable housing … and that this project should be able to move forward. I repeatedly instructed him he should contact LUC staff. I would also indicate that I should not have discussed anything with him. I’ve informed Mr. Orodenker” – Daniel Orodenker, executive director of the LUC – “and want to bring this to the attention of the commission.” Cabral insisted that the communication would have no influence on her eventual decision in the case.

Scheuer then directed his comments to Steve Lim, the attorney representing WHI, rather than to La Pinta, seated directly to Lim’s right.

Noting the state law and LUC’s own rules that prohibit ex-parte communication, Scheuer said: “I will note for the record that a member of your management team communicated with a commission member, in violation of Hawai‘i Revised Statutes and administrative rules, with the intention of providing the commissioner with information to influence her vote. …

“You need to advise your clients to avoid any contact with the commission. All communication should be through the commission’s executive director or staff.” “Understood,” Lim responded.

From Russia, With Smile

The first witness Lim called was Valery Grigoryants, who had traveled from Moscow to attend the hearing. Although Grigoryants understood and spoke some English, for the sake of accuracy, he testified in Russian, with his responses translated by Irina McGriff, a court-certified Russian interpreter from Honolulu.

Grigoryants identified himself as vice president of Arch, Ltd., “and the company Arch is owner of Waikoloa Highlands,” then, apparently correcting the translator, clarified: “was the owner.” According to an exhibit labeled “Corporate Structure of Waikoloa Highlands as of October 11, 2018,” submitted by Lim, Arch itself is a Bahamian-registered company that is wholly owned by Davies Partners Limited, which in turn is wholly owned by Vitaly Grigoryants. According to Valery Grigoryants, Vitaly is his brother.

“The company Arch at this time is no longer owner of Waikoloa, but this is just a different story,” he continued. At present, he said, the Vitoil Corporation owns Waikoloa Highlands. The same exhibit on corporate structure shows that Vitoil is itself wholly owned by Arch.

The problems with developing Waikoloa Highlands, Grigoryants claimed, can be traced back to the fact that he and his brother placed too much trust in Stefan Martirosian, who until 2017 was the public face of the project with authority to enter into contracts. Grigoryants said he met Martirosian in the late 1990s. Just “like Jewish people help Jewish people,” he said, “Armenian people help Armenian people.” Martirosian “seemed to me and my brother as a very intelligent, smart man,” Grigoryants testified. “Over time, we developed a trustful relationship, like brothers. Our relationship became so close that when his mother passed away, we came to the funeral, flying 13 hours, and when my mother passed away, he flew all the way from Los Angeles to Moscow for the funeral.”

Lim questioned Grigoryants on rumors that his company was involved in criminal acts. “One of the other issues has been the suspicion that this Russian company came to Hawai‘i to buy land with a lot of money and because of that they must be Russian gangsters or illegal money.”

“You know, I often hear this,” Grigoryants replied. “On the one hand, I get angry, on the other I start to laugh, because this is just typical stereotype. You know, I’d like to tell you at the beginning of the 1990s, my brother and I started business by selling shoes. Then we started to sell alcoholic drinks, then other things, all different types of things. We started to open stores. And then we were lucky to have the opportunity to be introduced to [the] oil business.”

Grigoryants insisted that the balance sheet of Arch, for the last 20 years, “everything was clean. Each year of the Arch company, from the auditor in London. It’s not a problem to provide documents. That’s why I’m smiling. I’m not a bandit.”

He went on to list some of Martirosian’s betrayals: “For example, without having authority from us he applied for money by putting land as collateral. And he took pocket money. There were many cases like this in California and the U.S. Virgin Islands as well. We have some land there, too.”

“In summer of 2017, we started to have concerns about him and we stopped trusting him,” Grigoryants told the commission. Companies controlled by him and his brother have now filed lawsuits against Martirosian in Armenia, in 2017, and California, this summer. Martirosian was tried in absentia in Armenia, with a guilty verdict issued in October 2017. When he flew into Moscow shortly afterward, he was arrested at the airport and held for extradition. According to Grigoryants, Martirosian was extradited to Armenia in July, where he is now in prison. More lawsuits may be forthcoming, Grigoryants said.

As for Martirosian’s role in Waikoloa Highlands, Inc., Grigoriants stated that “Mr. Martirosian was never owner of the company or any other companies in the United States as well as abroad. He was just a hired manager… And now he is fired from all the positions.”

Commissioner Gary Okuda wanted to know more about Valery Grigoryants’ own place in the corporate hierarchy. The chart outlining corporate structure indicates that Vitaly Grigoryants is the “ultimate beneficial owner” of all the entities, from Waikoloa Highlands up through Davies Partners, Ltd.

“Are you the ultimate beneficial owner or is your brother?” Okuda asked.

“The owner as you can see is my brother. We have a separate agreement where we make all the decisions together,” Grigoryants replied.

“I’m trying to determine the accuracy of Exhibit 28,” Okuda said, referring to the corporate ownership outline. “Is the first block at the top, which indicates Vitaly Grigoryants as ultimate beneficial owner – is that first block completely accurate or is there additional information that needs to be added?”

“No, everything is correct. No additional information needs to be added,” Grigoryants answered.

Who’s Who

Commission chair Scheuer also pursued a line of questioning about ownership.

“I want to make sure I heard you correctly earlier. You testified that Mr. Martirosian has no ownership in any of these entities? Is that correct?

Grigoryants affirmed his statement.

“So I’m trying to understand the exhibit,” Scheuer said, “the May 9, 2016, resolution signed by Aykaz Ovasafyan as well as Mr. Martirosian appointing Ms. [Natalia] Batichtcheva as director for Waikoloa Highlands, Inc.” The exhibit shows that Martirosian signed as a shareholder of Vitoil, which apparently held a 20 percent ownership in Waikoloa Highlands. Ovasafyan signed as the shareholder representative of Arch, which was listed as owner of an 80 percent share of Waikoloa Highlands.

“I see what you mean,” Grigoryants responded. He went on to describe Ovasafyan as “director of Arch company. And also he’s nominal [sic] of Arch, but beneficial owner of Arch is Vitaly.”

Scheuer asked for an explanation of the difference.

“There is a trust agreement between Vitaly Grigoryants and Ovasafyan where Ovasafyan is the nominal owner, where he keeps his shares in the trust for the benefit of Vitaly,” Grigoryants said. Scheuer asked that the trust agreement be entered into the record.

AsfarasMartirosian’sapparentownership interest in Vitoil, spelled out on the exhibit, that, too, was a mistake. Per Grigoryants, Martirosian “never had any interest and still now he doesn’t have any interest.”

Scheuer: “So, regarding Exhibit 5, it was given to us as an exhibit by you, as a basis for decision making, but you state now it is erroneous as regards Martirosian’s ownership and role?”

Grigoryants: “Yes. And I can explain. We give you what we have. There’s a mistake… We give it to you. We didn’t make any changes on that document.”

Scheuer then asked Grigoryants if he was listed in any of the documents provided. “I see your brother’s signature and name, but not yours. Are you pointed to anywhere in these documents?”

Grigoryants identified a letter on Arch Limited letterhead, signed by Ovasafyan and dated October 12, stating that Vitaly Grigoryants “is holding position of the president and Valery Grigoryants is holding position of the vice-president of Arch. Ltd.”

Additional documents submitted by Waikoloa Highlands show there are in fact two directors of Arch listed in corporate papers filed with the Bahamian government: Ovasafyan of Moscow and Roberto Rodriguez Bernal, of Panama.

Commissioner Okuda then questioned Grigoryants about his understanding and intentions regarding the land purchased in Hawai‘i.

“I would say we had the intention to develop, but we didn’t know where to start, how to start at that time just because we didn’t have any experience of development in the United States,” Grigoryants said. Martirosian then retained the services of planning consultant and former Hawai‘i County planning director Sidney Fuke to help with the process. “So the role of Mr. Fuke was to guide us, to explain. He was supposed to tell, advise Stefan on what

stages to go through and then Stefan was supposed to inform us.”

Okuda:“But in any event, you understood that certain approvals and certain things would have to be done with government entities to proceed, correct?”

Grigoryants: “Everybody knows. It’s common knowledge.”

Okuda: “And you agree that if the people working for your company have made promises to any of the government entities here in Hawai‘i your company is supposed to live up to those promises, correct?”

Grigoryants: “I don’t evade any responsibility. I accept full responsibility. I just regret that we discovered things too late.”

The Money Trail

Another issue that concerned the commissioners was financing. A document provided to the commission indicated that an Armenian bank wholly owned by Valery’s brother Vitaly Grigoryants had committed $45 million to Arch and had agreed to allow those funds to be transferred from Arch to Waikoloa Highlands, which would use the funds to develop the project.

“You say you have authority to make decisions,” commissioner Dawn Chang said in her questioning of Grigoryants. “What are you doing different now to ensure that the development proceeds that you didn’t do when Mr. Martirosian was in charge?”

Grigoryants noted that there was a new director, Natalia Batichtcheva, in place. “Secondly, we hired in project manager [Joel] La Pinta. We secured financing… We are planning, since we are not local, to invite a local developer for mutual cooperation.”

“In 2008,” when the LUC issued its approval for the project, “we didn’t know about the subdivision, that we had to make the project,” Grigoryants said.

Under further questioning, Grigoryants said that in 2010, his company did have $92 million available for financing the project, but invested in the movie industry instead. “If we knew, we could have invested into this project.”

Chang probed further: “This 45 million dollars set aside for or committed by your brother’s bank, if you have different opportunities, other than this Waikoloa development, will you withdraw that money for this project?”

Grigoryants said that wouldn’t happen.

“Would you put that money in an escrow account to ensure it goes to this project?” Chang asked.

“It’s not a business approach,” Grigoryants answered. “Nobody would approve 45 million in escrow for 10 years. We don’t need 45 million every year.”

La Pinta provided additional testimony on Waikoloa Highlands’ capital needs. Asked by Edmund Aczon whether he had a financial plan for the project, La Pinta said he did. “It is my responsibility,” he said. “I did the financial modeling.”

How much will the project cost? Aczon asked. “Is 45 million enough?”

“Actually, it’s way more than we need,” La Pinta said. “What happens is, this is done in increments. As increments go forward, we sell lots, which reduces capital costs. This particular model here, the peak capital during the entire sell-out of the project toward development costs comes to $15.8 million.”

Under the scenario outlined by Lim in statements to the LUC and by La Pinta, the lots should be able to be sold before any actual “backbone infrastructure” – roads, water lines, other utilities – are developed. After the county grants tentative approval to a subdivision plan, Waikoloa Highlands will register the lots with the state Department of Commerce and Consumer Affairs (DCCA). That paves the way for the DCCA to issue a preliminary order of registration, which allows the developer to enter into contracts for sale of lots. Eventual installation of infrastructure is assured through the posting of a completion bond.

La Pinta elaborated: “You wouldn’t subdivide and put streets in for 398 lots,” he said. “You do it in increments. Each increment is done as sales occur. Proceeds from sales would come back to help fund the project. So when I described that number” — $15 million – “it was based on a certain rate of sales, a certain rate of doing development incrementally.”

Chang asked La Pinta whether he was confident Waikoloa Highlands could proceed on the existing environmental studies that were completed more than a decade ago. “You are confident those studies are still relevant and pertinent to today?” she asked.

“Yes,” La Pinta replied.

The sufficiency of environmental studies was a theme picked up by Scheuer as well, who noted that since the LUC approved the original docket, the State Historic Preservation Division had revised its rules.

Regarding water, Scheuer asked if La Pinta knew how much the water demand for full build-out would be.

“I only focused on the first phase,” La Pinta replied. “We would have to execute an extension agreement” with the private water company now expected to serve the development.

“Do you know which aquifer the water comes from?” Scheuer continued.

“We rely on West Hawai‘i Water Company. It’s not within the purview of our work,” La Pinta said.

“Sorry,” Scheuer said. “I understood as an expert in development, you’d be able to testify as to water for the entirety of the project.”

Was La Pinta aware of the sustainable yields of the aquifer that the project would draw on? Scheuer asked.

No.

“Are you aware the [state] Water Commission is going to go out with revised numbers for those aquifers?”

No.

“Are you aware that the Water Commission is preparing to revise downward the sustainable yields for the two aquifers in this area?”

No, La Pinta answered.

“Are you aware the downward revision of sustainable yield could result in designation of these areas as groundwater management areas?”

La Pinta said he was aware of that, but acknowledged he did not know much about it.

Scheuer then asked if La Pinta was familiar with Unite Here v. City and County of Honolulu, the Hawai‘i Supreme Court case decided in 2010 that addressed the question of the shelf life of environmental disclosure documents.

La Pinta acknowledged he was not familiar with it.

Affordable Housing

A condition of the LUC approval of the petition to reclassify the land from Agricultural to Rural was that the developer satisfy Hawai‘i County conditions for an affordable housing contribution. Chapter 11 of the county code describes how those contributions are to be calculated. For the project anticipated by Waikoloa Highlands, the developer needs to earn affordable housing credits equal to 20 percent of the total number of residential lots in the project. With 398 residential lots planned, that number comes to 80. Generally, one affordable unit equals one credit.

As Environment Hawai‘i reported in September, the county’s Office of Housing and Community Development (OHCD) signed off on a deal where some 11.7 acres of land owned by Waikoloa Highlands was transferred to a for-profit company, Plumeria at Waikoloa, which in turn resold it to a third company, Pua Melia, which is in talks with the county to develop affordable housing and a commercial center on the site.

But because of a drainage channel that cuts through the property, at most just 32 units of affordable housing can be built by Pua Melia, far short of the 80 credits required by the county’s affordable housing law.

Although the OHCD administrator gave Waikoloa Highlands a release from further need to comply with affordable housing conditions in July 2017, the county has now taken the position that Waikoloa Highlands has not yet fulfilled the affordable housing condition. In connection with challenges to the sufficiency of the affordable housing agreement, representatives of Waikoloa met on October 19 with the OHCD to discuss the possibility of conveying another three or four acres to an entity that would develop low-cost housing.

The county’s statement of position on the show-cause order, drafted just days before the LUC hearing, states: “The county has concerns about the affordable housing agreement and affordable housing release, but believes petitioner [WaikoloaHighlands] is engaging in good faith negotiations to fulfill its affordable housing obligations. The affordable housing agreement was supposed to be in compliance with Chapter 11, article 1 of the Hawai‘i County Code and required the land to be conveyed to a nonprofit corporation. … and that the land be sufficient to accommodate the number of affordable homes the developer would have needed to build.

“Although the affordable housing release was premised upon the land being conveyed to a nonprofit, the land was conveyed to Plumeria at Waikoloa LLC. This entity does not appear to have been a nonprofit entity and subsequently sold the land to another entity for a reported $1.5 million. That entity has submitted an application for affordable housing project to OHCD but this project will not accommodate the number of affordable homes that the developer would have needed to build. A nonprofit entity has expressed interest in a project to build more affordable homes than required if it had sufficient land.”

At the commission meeting, La Pinta described a recent meeting with the OHCD. “They asked us to come and meet with them to acquire more land to accommodate 80 affordable units on the site. … We would like to accommodate them. They’re taking about working with a nonprofit. They like to do the 80 town-homes as affordable rentals. … We ended it with, we’re willing to work with them,” La Pinta said.

Commissioner Edmund Aczon raised the matter of Waikoloa Highlands’ ultimate responsibility to comply with the affordable- housing requirement, suggesting that conveying the land to Plumeria at Waikoloa didn’t necessarily absolve Waikoloa Highlands from its responsibilities. “The petitioner is responsible to make sure the conditions are met,” he said.

La Pinta responded by saying that after the transfer, “the county agency is in charge from that point on to work with developers.”

Aczon: “I beg to differ.”

Jeff Darrow, planning program manager for the county Planning Department, was questioned by Lim on the sufficiency of the affordable housing agreement entered into by the county’s Housing Office and its subsequent release of Waikoloa Highlands from the housing condition.

“Why was this release agreement executed by the county?” Lim asked.

“I can’t answer that question,” Darrow replied.

When asked who might be able to,Darrow identified the housing administrator, Neil Gyotoku, and the deputy corporation counsel advising his office, Amy Self.

Darrow went on to say that at the time the housing agreement was signed and the release granted, “it was the understanding that that agreement would satisfy the affordable housing requirements” imposed both by the LUC and by the county’s own rezoning ordinance, last updated in 2013.

“Why the change of position?” Lim asked.

“A question has arisen on the transfer of the 11.7 acres to an entity that was not considered a nonprofit entity.”

Lim pursued the topic: “The only issue the county had with the method of satisfying the affordable housing requirement was that the conveyance was made to a for-profit company rather than a nonprofit?”

The county attorney, Ron Kim, objected at that point, stating that Darrow wasn’t the person who could answer that.

Lim: “The petitioner is concerned. We had an agreement. Now the county says you didn’t do what you needed. We’re trying to determine what, exactly, they want us to do.”

“The position that we have is that currently, in looking at the release agreement and looking at Chapter 11, which is the housing code, is that there is a conflict and that needs to be resolved,” Darrow said.

Commissioner Okuda asked Kim whether he could detail how WH has not satisfied the affordable housing condition.

“The main factual problems with the agreement are that it doesn’t comply with its own terms or the county code. The county cannot contract to trump its own code,” Kim replied. The code requires “that if the developer is to donate land to either a nonprofit or county in lieu of developing it itself, the conveyance must be to either the county or a nonprofit. In this case, the conveyance was to a for-profit, which turned around and sold the property for a reported $1.5 million.

“And the other problem with the property that was conveyed is that it is not supposed to have any unusual characteristics that would make it difficult to develop. Yesterday, Mr. La Pinta testified to the substantial drainage easement that made it difficult to develop, and also the unusual shape. Finally, the land donated is supposed to be sufficient to accommodate the number of affordable housing units which the developer is required to build, and in this case the actual owner now of the property is saying he can only build – I believe the number we had yesterday was 32 affordable housing dwellings. So those are the problems I see. Also, by its own terms, the housing agreement claimed Plumeria at Waikoloa was a nonprofit, which was not true.”

“I think we have a different understanding than the petitioner,” Kim concluded, “but if we could go through with negotiations to donate an addition three acres, then it sounds like the petitioner would be able to meet the affordable housing requirement.”

When Okuda raised the matter of estoppel – the idea that the county could be barred by raising a claim of a violation when its own agency had signed off on the proposal – Kim replied that this was not an issue. “The county can’t be bound by estoppel,” he replied, arguing that the agreement was an “ultra vires act” – that is, the housing agency exceeded its legal authority when it signed the agreement and release.

Okuda: “So, even if the petitioner might have been misled into believing it had complied with the affordable housing agreement, because the county wasn’t authorized to take the action, then its kind of the petitioner’s tough luck.”

Kim noted that the county code was a public document, easily obtained. “If the petitioner had read the code,” he said, “they would understand that they had not fulfilled the code.”

Even so, the county’s position supports as appropriate the current LUC classification of the land as Rural.

In the Event of Reversion

Much of the questioning of Darrow was focused what might happen if the LUC reverted the land to Agricultural.

Darrow outlined some of the hoops the landowner would need to go through to develop the land in a fashion similar to that already proposed. There would need to be a zone change, since the property is now in the county’s rural zone, conforming with the LUC designation. The one-acre zoning for rural residences would need to be changed to Family Ag, one-acre, or FA 1a. However, Darrow added, “In the record, it shows the actual agricultural significance of this land is minimal.”

Commissioner Chang observed that even if reversion occurred, “There is still potential use of this property,” so long as the landowner’s plans were consistent with county zoning and its General Plan.

And, in any case, the same requirement of Chapter 11 for affordable housing contributions would apply, Darrow noted.

The current zoning ordinance expired in March, he said, so even if the LUC did not revert the land, Waikoloa Highlands would still need to get the zoning ordinance of 2013 “refreshed,” as he put it. If reversion did occur, then things would be more complicated, requiring an amendment to the General Plan.

Chang also noted another option if the LUC ultimately voted to revert: Restarting the boundary amendment process before the commission.

Lim had a final question for Darrow: If the commission reverted the land “this month” and the county processed the General Plan amendment required to accommodate the development on Agricultural land, how many years would it take from today to complete the general plan amendment?

“Just a guess, but several years,” Darrow replied.

“In excess of three years?” Lim asked.

“Could be.”

“Rezoning, how long does that take?” Lim asked.

“Normally six months to one year.”

Lim: “So the processing time for as re- do of the project might be a minimum of four years.”

Darrow: “It very well could be.”

‘Due Process’

Hawai‘i County did not object to keeping the Waikoloa land in the state Rural land use district, but did list a number of conditions, in addition to that of affordable housing, that it claimed Waikoloa Highlands had yet to fulfill.

The state the Office of Planning, on the other hand, did not object to reversion to Ag. The requirements for traffic management improvements, affordable housing, archaeological preservation, Civil Defense measures, failure to file notice of changes in ownership, and failure to file annual reports were among the unfilfulled conditions that Dawn Apuna mentioned in explaining the office’s position.

In addition she said, there had been “no substantial commencement of the use of the land … No document draws the connection between Martirosian’s bad acts and the failure to move forward. It is unclear why the project has not substantially commenced since Martirosian was removed two years ago.”

The Office of Planning had no witnesses to call, although Apuna was accompanied by Rodney Funakoshi, administrator of the OP’s planning program.

Lim attempted to have Funakoshi called as a witness, even though Apuna had not offered him as one.

“If the Office of Planning is going to rely on written testimony, then we have the right to question the witness who supports it.”

“We’re in a show-cause proceeding,” Lim said. “The petitioner wants to prove

the similarity or dissimilarity with other show-cause proceedings.” After a short executive session, Scheuer rejected Lim’s request. “When you were explaining the nature of your inquiry, I said they went to argument more than to specific questions required of a witness from the Office of Planning. I clarified that we would be providing an opportunity for all parties to still present closing argument as well as briefing.”

Lim: “For the record, we believe the testimony of Mr. Funakoshi would assist the petitioner’s argument that the present order to show cause proceeding is subject to potential claims for violation of due process and equal protection as compared to other similarly situated properties. The only way I can prove that is through the Office of Planning witness.”

“You’ve stated that on the record,” Scheuer noted. He added, however, “I would clarify that for now, the possibility that Mr. Funakoshi could be called hasn’t been closed.”

As the meeting drew to a close, commissioners described the nature of materials that they wanted the parties to file briefs on. The county was asked to provide written documentation of its position on affordable housing and to describe the county’s planning process.

Okuda requested briefs on what, in light of a court case brought by Bridge ‘Aina Le‘a against the state, constitutes “substantial commencement of the use of the land.” In addition, he asked for “presentation of legal authority … as to whether the internal management of the petitioner is relevant to this proceeding.”

Chang, on the other hand, suggested the Bridge ‘Aina Le‘a case wasn’t germane to the Waikoloa situation. “I would like the parties to brief, in looking at this decision and order, whether – what is the standard of review in light of condition number 2 and condition number 3.” Condition 2 defines completion of the project: “petitioners … shall complete buildout of the project,” going on to define it as “completion of backbone infrastructure to allow for sale of individual lots.” Condition 3 allows for reversion in the event of failure. “I don’t even know whether ‘Aina Le‘a even applies, since in this case, the decision and order itself defines failure,” Chang said.

Commissioner Cabral: “In addition to all the other homework assignments, I would like to ask the petitioner if we could get clarification, a written statement or clarification, of the items that are different from what was previously reported in writing.”

The briefs and additional information are due by November 19, eight days before the next scheduled hearing. The Land Use Commission posts materials it receives from the parties on its website: luc.hawaii.gov.

— Patricia Tummons

Leave a Reply